How Does the Coffee Trade Work ?

How Does the Coffee Trade Work?

The coffee trade operates through buying and selling contracts for coffee beans, which are used by traders to speculate on the market's high price volatility.

Buyers, such as coffee roasters or distributors, enter into contracts to purchase coffee beans at a future date and predetermined price. Sellers, typically coffee producers or exporters, enter into contracts to sell their coffee beans at a specified quantity and price.

These contracts allow participants to hedge against price fluctuations and manage risk. Speculators, including investors or traders, engage in the coffee trade to profit from price movements by buying and selling contracts without the intention of physical delivery. The coffee trade relies on these contracts to facilitate transactions and enable market participants to navigate the dynamic coffee market.

How Are Coffee Beans Traded?

Coffee beans are traded through various financial instruments, including stocks and exchange-traded funds (ETFs), futures and options contracts, and contracts for difference (CFDs).

These instruments provide investors and traders with different ways to participate in the coffee market and manage risk. Here is how to trade coffee futures.

Stocks and ETFs: Investors interested in the coffee industry can buy stocks of coffee-related companies listed on stock exchanges.

These companies may include coffee producers, exporters, importers, roasters, or retailers. By investing in these stocks, individuals can gain exposure to the performance and profitability of the coffee industry as a whole.

Additionally, there are ETFs specifically focused on the coffee sector, which allow investors to diversify their exposure across multiple companies within the industry.

Futures and Options: Coffee futures and options contracts are widely used in the commodities market to trade coffee beans.

Futures contracts provide a standardized agreement to buy or sell a specific quantity of coffee beans at a predetermined price and future delivery date.

These contracts enable market participants, such as coffee producers, exporters, and traders, to hedge against price volatility and lock in future commodity prices.

Options contracts, on the other hand, give the holder the right but not the obligation to buy (call option) or sell (put option) coffee futures contract at a specified price within a certain time frame.

Options provide flexibility to traders, allowing them to take advantage of price movements in the coffee market without the obligation to execute the trade.

CFDs: Contracts for Difference (CFDs) are financial derivatives that enable traders to speculate on the price movements of coffee beans without owning the underlying asset.

CFDs allow traders to profit from both rising and falling global coffee prices by entering into a contract with a broker.

The trader and the broker agree to exchange the difference in the coffee price between the contract's opening and closing positions.

Trading coffee CFDs provide traders with leverage, allowing them to trade larger positions with a smaller amount of capital.

What Market is Coffee Traded on?

Arabica coffee beans and Robusta coffee beans are primarily traded on the Intercontinental Exchange (ICE). The ICE operates futures and coffee options markets specifically dedicated to coffee trading.

Market participants can trade Arabica and Robusta coffee through these contracts, which allow them to speculate on the future price movements of coffee or manage price risk.

Additionally, Arabica coffee futures contracts are also traded on the New York Mercantile Exchange (NYMEX).

The NYMEX offers a platform for trading various commodities, including energy products and agricultural commodities like coffee.

Arabica coffee futures traded on the NYMEX provide another avenue for market participants to engage in trading coffee and investment.

These exchanges provide a centralized and regulated marketplace where buyers and sellers can come together to trade coffee contracts.

The trading of coffee futures and options on these exchanges allows participants to establish positions, hedge against price fluctuations, and take advantage of opportunities in the coffee market.

Who is the Largest Coffee Trader in the World?

The largest coffee trader in the world is Neumann Kaffee Gruppe (NKG). NKG is a German-based coffee trading company and is one of the leading green coffee merchants globally.

They are involved in the sourcing, processing, and distribution of green coffee beans. NKG operates in more than 30 countries and has a significant presence in key coffee-producing regions.

They work closely with coffee growers and have established relationships throughout the coffee supply chain.

How Do You Become a Coffee Trader?

To become a coffee trader, there are several key steps and qualifications to consider:

Industry knowledge: Understand coffee production, varieties, quality standards, market trends, coffee consumption rate, and trading practices.

Business acumen: Know supply and demand dynamics, pricing, risk management, and general business principles.

Negotiation skills: Be proficient in negotiating favorable terms with growers, exporters, and other traders.

Education and experience: While not mandatory, a degree in business or relevant experience in the coffee industry can be beneficial.

Language skills: Being bilingual or multilingual can help in communicating with international growers and traders.

Networking: Build connections within the industry through events, associations, and professionals for collaboration and opportunities.

Interesting Read: Coffee Machine Subscription

FAQs

What is the coffee futures trading strategy?

Common coffee trading strategy in coffee futures trading include trend following, spread trading, seasonal trading, fundamental analysis, and technical analysis.

What exchange is coffee traded on?

Coffee is primarily traded on the Intercontinental Exchange (ICE), with Arabica and Robusta coffee beans being traded on this exchange. Arabica coffee futures are also traded on the New York Mercantile Exchange (NYMEX).

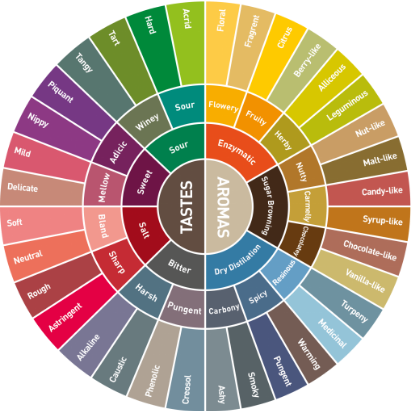

Good Tasting Coffee: How to Identify Coffee Flavors

In order to appreciate the different types of coffee available, it's important to cultivate an awareness of its unique characteristics. Let's take a look at the way coffee connoisseurs judge different cups of coffee.

Aroma

The scent of a cup of coffee has a direct influence on how we perceive its flavor. As you drink coffee try to notice if the scent is smoky, fruity, earthy, spicy, nutty or grassy.

Acidity

One of the most defining characteristics of a cup of coffee is its acidity. This is the sharp, bright tangy quality of coffee that perks up our senses. Coffee doesn’t necessarily contain just one type of acid, either. It may contain citric acid, malic acid (fruity in flavor) or even quinic acid from stale coffee, which gives us stomach aches.

Body

This is the weight, thickness and texture of coffee in your mouth. The body of different types of coffee falls on a spectrum of light- to full-bodied viscosity (thin to thick).

Flavor

This is where comparisons come in handy and there is some overlap between aroma and flavor. Your coffee might taste bitter, sweet, savory or sour with common comparisons to chocolate, wine or fruit.

Related Posts